Written by Dharminder Biharie,

Business Development Manager Xerox Graphic Communications, The Netherlands

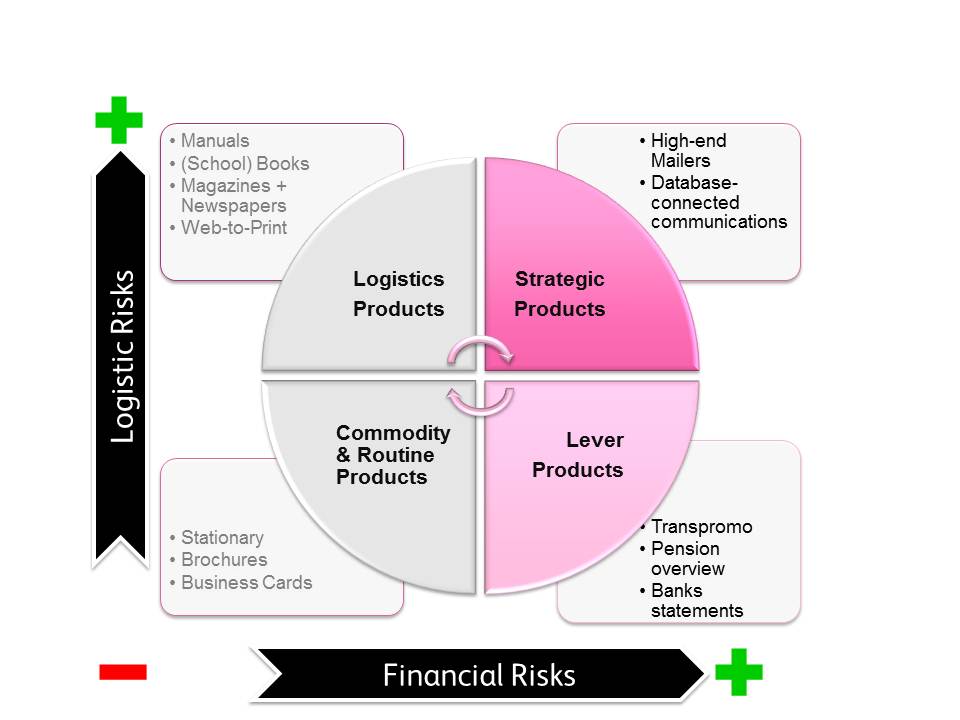

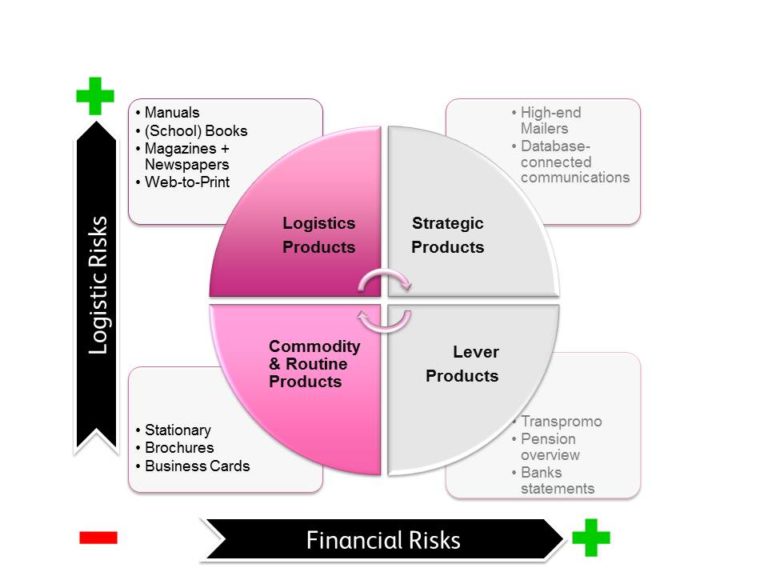

Last week we introduced the concept of using a quadrant model to analyze your business offerings in terms of financial and logistical risk. We discussed Commodity/Routine and Logistical products, and how they can impact your business.

Today we will continue the analysis by discussing Strategic and Lever products, as well as taking a look at how all four of these quadrants pertain to your business. Let’s get started.

3. Strategic Products: High Financial Risk/High Logistical Risk

Strategic products are characterized by a high degree of financial and logistical risk. Why? Because these products are often considered to be complex, involving such things as the merging of multiple customer databases. 1:1 communications with many variables can be an examples of this.

With these products, one error in the database can spell the end of a customer relationship or deal. As an example, I think of a high-end personalized vehicle trade-in mailer I worked on with a Xerox Premier Partner, Jubels. In this particular example, the dealer would offer you a trade-in price for your vehicle that you couldn’t refuse. The mailers contained an incredibly high-degree of personalization: the front cover featured your car with the right color, the right options and even your very own license plate. This served as an instant point of personal recognition.

The inside pages displayed three cars with very attractive price points…and each offer was already calculated and tailored specifically to the recipient using an algorithm. This was made possible because the dealer already knew when you purchased the vehicle, your service check history and your mileage or kilometers. In Holland we have a database owned by the car association with the trade-in prices for all used cars.

All databases were combined to make you an offer you couldn’t refuse. Interesting? Yes!! Why would you wait on this great deal? The answer: not many people did wait. The response rate on the mailers was almost 50% and the conversion rate was between 16-22%.

Imagine if we made a mistake in the database. The financial implications would have been huge and is why this type of offering carries such a high financial risk. Fortunately, the nightmare of the financial risk was avoided because Jubels never took ownership of the database. While they created the solution and made the car dealer’s vision a reality, the database was ultimately owned by the dealer and their agency. They reviewed it and they owned the final sign-off prior to the campaign being launched. Had we owned the database and had there been an issue, we would have been responsible for this financial risk.

4. Lever Products: High Financial Risk/Low Logistical Risk

Lever products ensure that a follow-up action is taken by the recipient of the document. Possible actions include extending your subscription, sending of payment and cancellation of service. In these scenarios, the financial risks are often high. And while these products often involve databases and personalization, they are of a much lesser complexity than when compared with Strategic Products.

These typically involve information that is redundant and comes from a single database, rather than the stitching of several databases.

Suppose you handled invoice services for your customers, and you must compile the data and print these invoices at the same time each week. The complexity of the job is rather low: simply merge, print, stuff them into envelopes and ship them to the correct address.

Your customer has an expectation that the invoices will be printed and mailed on-time. They know from experience that their customers require a certain time window in order to complete payment. But, as the print provider, what if your print equipment, enveloping machine or even the postman is late? This directly impacts your customers cash flow. In order to be successful in this business model, you will need to eliminate financial risks.

Grab a pen and paper: you’re in control. Time for a Graphic Arts test!

After reading, you may consider projecting this quadrant model onto you own business.

To benchmark your own organization, I challenge you to see how much revenue you make in each of the four quadrants. This test is purely meant to help you understand your business model, so don’t try and fool yourself. Be honest about your business and you can learn a lot from this exercise.

For example, if more than 60% of your revenues are in the Commodity Quadrant, you should consider the risk of your business model and your company profile. Your revenue can easily vaporize because many print providers can offer the same services.

I know comparing numbers can be easy, but enacting change and transformation is not. If you feel it is time to consider real strategies for transforming your business but are scratching your head at where to start, I encourage you to reach out.

Myself and my Xerox Business Development colleagues from around the world are happy to help you transform your business model. We are interested in your business and helping you succeed – which is why we have over 70 business development tools and topics!

Looking at the quadrant model, where do you see yourself? What do you see as your biggest opportunities?

—

Dharminder Biharie is a Business Development Manager within Xerox Netherlands. To get in touch with Dharminder, feel free to contact him via email.

Dharminder Biharie is a Business Development Manager within Xerox Netherlands. To get in touch with Dharminder, feel free to contact him via email.

One Comment

Comments are closed.

For growth in business proper strategy should be needed and ability to adapt any kind of situation easily. This is really a great post and very useful too.