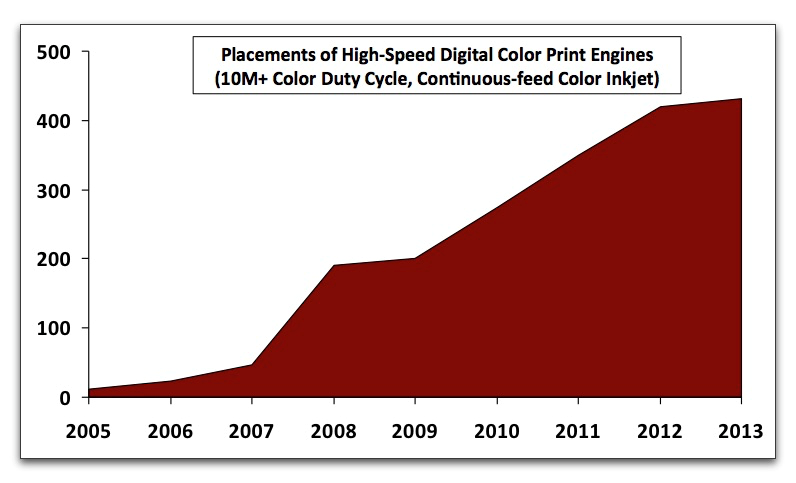

The recent blog entitled, “Are We Leaving Small and Mid-Sized Printers Out of the Inkjet Revolution?”, talked about how three issues: acquisition costs, cost per piece and equipment size, may be slowing the adoption of inkjet production presses. There is some evidence to support this. According to InfoTrends’ Quarterly Market Tracking Program, the acquisition of high-speed color inkjet production devices started slowing somewhat in 2013. InfoTrends expects placement growth to continue, but at a less meteoric 4.8% compound annual growth rate through 2018.

What is causing this slow-down in adoption? We hear in our work with commercial and in-plant printers that acquisition costs, cost per piece and equipment size are issues and we believe that overcoming these issues will accelerate the adoption of inkjet production presses by smaller commercial and in-plant printers. Not many companies can afford an inkjet system that can easily exceed $2 million in printer hardware acquisition alone (not to mention other improvements that may be required).

Issues Slowing the Adoption of Inkjet Production Presses

Simply put, there is a finite and small universe of companies that can afford to spend millions on inkjet production presses, especially if new finishing equipment is also required. For the average general commercial or non-transactional in-plant printer, the cost has to come down from the existing prices for high-speed, roll-fed devices if the inkjet revolution is going to have an impact on mid-sized print service providers.

Size can be an issue as well. The footprint of an inkjet production press can be long and may also require high ceilings. But that may only be a small portion of the total space required when you start to consider the equipment to load the paper rolls and the one or two in-line finishing lines that may be connected to the press.

For companies that are on the fence due to acquisition costs or volume requirements, there may be “soft advantages” that become important. Sometimes you can make the case for faster turnaround. The speed of these devices can result in the reduction of service level agreements. For some companies, the ability to delay printing for a day or two to gather more marketing and sales information has significant value.

Other times you can make the case that there is more value when you migrate from black and white to color pages or migrate from static offset pages to variable data printing. Both can result in marketing and sales advantages.

But even with the soft advantages, there is still the issue of high capital costs. It is likely that a reduction in size and acquisition costs would result in a more viable option for smaller commercial and in-plant printers.

Initial Thoughts on Xerox Rialto 900 Inkjet Press

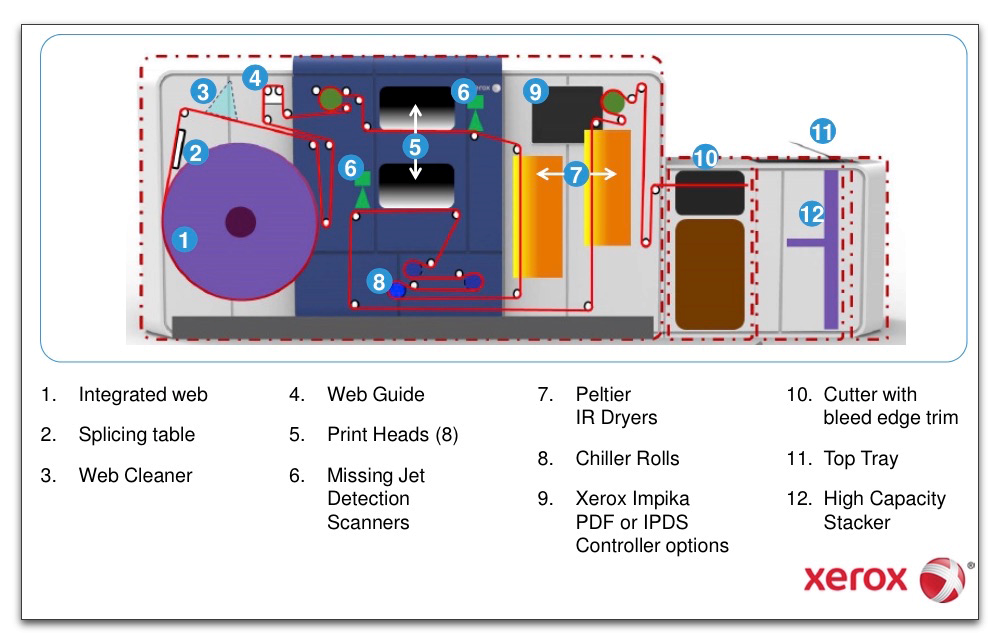

The Xerox Rialto 900 Inkjet Press is a new breed of inkjet technology, announced and shown at Hunkler Innovationdays late last month. As a roll to cut sheet device, it has a smaller footprint measuring 11’9”L x 5’1”D x 5’3”H.

The unusual paper path (see illustration) includes chiller rollers to condition the paper and an Infra-Red dryer.

The engine is a proven Impika Drop on Demand, Piezoelectric technology. It is based on Kyocera KJ4B 600 dpi aqueous inkjet print heads, said to deliver a perceived 1,000 x 1,000 dpi resolution. Perhaps most important is the base cost, which places it around the same price point of high end, cut sheet, electrophotographic (toner) based devices on the market today.

An inkjet production press with a lower cost of entry and a smaller footprint will make inkjet production printing a more viable option for smaller in-plant and commercial printers. Expect to hear more feedback in the coming months, as installations grow nearer.

—

Howie Fenton is Associate Director of Operational Consulting at InfoTrends. For 25 years, he has worked with in-plants and commercial printers on: benchmarking operational and financial performance, recommendations to increase productivity/reduce costs and strategies to increase value.To email click here.

Comments are closed.