The investment momentum toward inkjet production presses continues to increase as evidenced by recent presentations and articles. The Third Annual Inkjet Summit earlier this year was the largest and the best attended so far. Instead of splitting attendees into three groups this year, attendees were split into four groups based on four market segments: books, direct mail, commercial, and transactional printing. Sponsors presented case histories in each of the market segments, industry experts offered research on the projected growth within those markets, and inkjet experts made presentations discussing implementation issues and answers.

While most people understand the impact of inkjet production printing in the commercial printer space, not everyone understands the increasingly important role within the government sector. On May 14th, seventy in-plant managers from across the country attended the inaugural Digital Printing in Government in Higher Ed Conference at the GPO (Government Publishing Office) in Washington D.C. The show, which was sponsored by In-Plant Graphics Magazine, included a presentation by two state printers from Colorado and California.

Mike Lincoln from Colorado talked about his recent conversion from toner to inkjet production while Jerry Hill from California talked about his plans to migrate inkjet equipment. Both state printers discussed the growing role of inkjet production equipment in their printing facilities.

The cover story of this month’s Inkjet Age Magazine is entitled, “What’s Your Inkjet ROI?” In the article, co-written by Jim Hamilton and myself, we talk about popular print applications, concerns about paper/quality and the growing opportunities to invest as less expensive equipment comes to market. One of the more interesting tables is entitled, “The Impact to Print Volume,” which looks at percent changes in the total cost of manufacturing of the equipment, maintenance, consumables, and paper, as the page volume increases.

Projected Growth

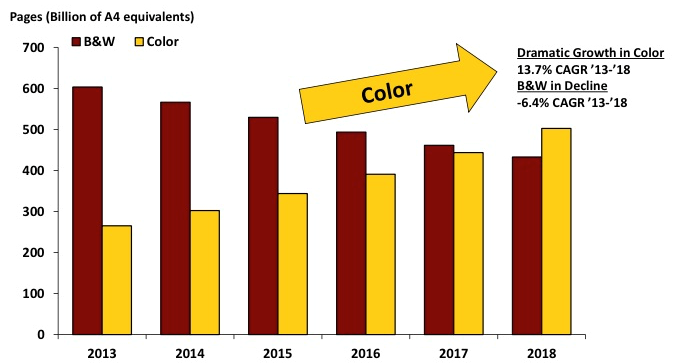

According to InfoTrends, the migration from black and white pages to color pages is continuing and it is fueled in part by the adoption of inkjet equipment. In the InfoTrends US and Western Europe Production Printing and Copying Market Forecast, the growth opportunities remain high for color inkjet production printing. In 2013, production color inkjet accounted for 36.6% of the total production digital color volume in 2013. Which is quite impressive since there was hardly any production color inkjet volume at all as recently as 2008.

Much, but not all, of the growth in production color volume can be attributed to inkjet. According to InfoTrends’ 2013-2018 U.S. and Western European Production Printing & Copying Market Forecasts, production color volumes totaled about 265 billion impressions in 2013 and will grow to more than 500 billion by 2018. By 2016, production color inkjet volume will exceed that produced by color toner devices.

As you can see in this figure the black and white pages are expected to decline by 6.4% while color pages are expected to increase by 13.7%. By 2018, InfoTrends predicts that production color inkjet will account for 59.1%, and all of this is happening despite the fact that color toner continues to grow. For more information feel free to review the InfoTrends webinar by Barb Pellow and Jim Hamilton for Xerox entitled Inkjet: Closing the Gap.