Two recent sources are painting an interesting portrait of the state of the printing industry. At the recent EFI Connect Conference, my old friend Andy Paparozzi discussed the latest Epicomm State of the Industry Report.

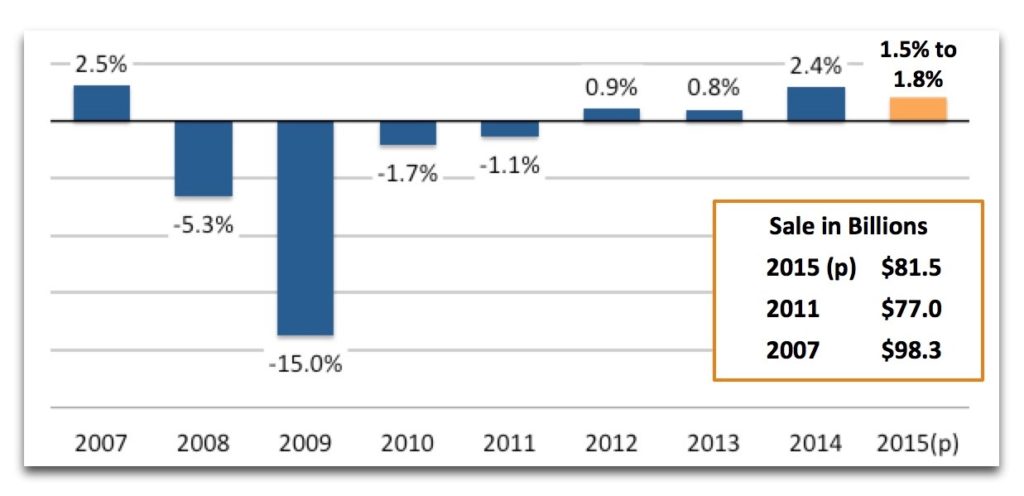

Andy predicts an increase in sales for the fourth straight year in a row. Although not a significant increase, it is a stark contrast to the four previous years of staggering losses.

The second source is an article entitled Selling to the Enterprise Market published by WhatTheyThink.com. Authored by InfoTrends Group Director Barb Pellow, the article cites the latest InfoTrends research Micro to Mega: Trends in Business Communications, which asked more than 800 enterprise marketers about their communication priorities.

Not surprisingly the research confirms an ongoing shift in marketing preferences from traditional print to non-print channels such as email, web, and mobile marketing. The report predicts that print will remain an important marketing channel, comprising over 25% of the marketing budget over the next two years. But online and mobile will experience growth accounting for 30% of spending in 2015 and is predicted to grow to 33.6% in 2017. More specifically, mobile will grow at 7.8%, online/web will grow at 5.2%, and video will grow at 0.9%.

Conclusion

The good news from all this is that the printing industry has reversed four years of significant losses with 4 years of modest gains. The bad news, however, is that sales growth is painfully slow. And there is an ugly component to the state of the industry not addressed by these national studies. According to BloombergBusiness, “Four states – Alaska, North Dakota, West Virginia and Wyoming — are in a recession, and three others are at risk of prolonged declines, according to indexes of state economic performance tracked by Moody’s Analytics.”

Regardless of this regional recession, all the companies we work with complain about pricing and profitability challenges and are searching for growth opportunities.

If you are looking for ways to improve sales and profitability you should start by answering 3 questions:

- How do you track your customers changing needs?

- How do you measure and improve your customers perception of value, compared to your best competitor?

- How do you integrate this information into an actionable plan?

—

Howie Fenton is the Vice President of Consulting Services for IMG. For 25 years, he has focused on benchmarking operational and financial performance for enterprise, in-plant and commercial printers. For more info, e-mail hfenton@imgresults.com.

How do you track your customers changing needs? One mix is to record annual survey results or track feedback loops, but this always needs to be backed with relationships. And that means meeting with and knowing your customers. Get out of the shop and rank demand and business goals. Those goods and services which score high in what you’re good at – do those and repeat. Find a rate model that works. In areas you do not, consider managing a competitor services. Sometimes “co-competition” rises all boats vs. thinking of outside vendors only as competitors.

In-Plant managers, in my opinion, have to take some capital risks and fund platforms to build upon — sometimes before customers know it. Budgets often lag demand, so to be a step ahead you have to plan ahead. At times I have failed to “get the software out of the box” on investments, no doubt, but other times I’ve scored big. To diversify into the services Howie’ blog notes here also takes staffing with new skills. And that’s a challenge if you’re recruiting solely in the printing space or limited to flat print industry salary ranges.

Awesome feedback and insights – thanks so much for taking the time to write, Steve!

Bill (Xerox)

Thanks for putting this information out there Howie. Your message speaks to the real challenges and the real successes we’re experiencing. The state of affairs reminds us to never stop innovating, nothing stays the same; we need to rise above the noise with new ideas.