The state of the industry for variable data printing (VDP) is strong. InfoTrends monitors the VDP marketplace in three ways:

- Retail sales of software to end users.

- Retail sales by company type (commercial vs. in-plant printers).

- The retail value of VDP products (sold to print customers).

While sales of VDP software has peaked, the opportunity for additional sales of VDP pages remains high. According to the latest 2015 research by InfoTrends, US Production Software Investment Outlook, the overall compound annual growth rate (CAGR) of VDP software is 6.2%, resulting in projected sales of $105.8 million in 2019. The growth in North America comes mostly from existing customers buying professional services, additional modules with the additional functionality, and maintenance contracts.

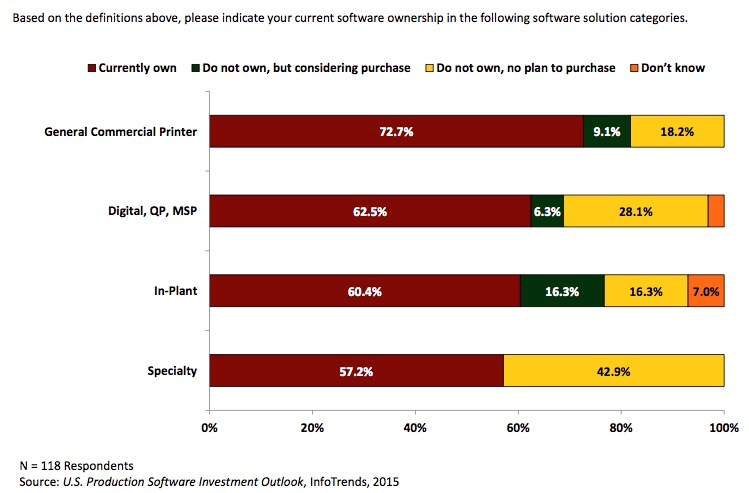

The installed base of users has remained between 60-65% for several years now. As you can see in the chart below, the highest adoption rate by company type is from commercial printers, followed by digital printers, quick printers and marketing service providers, followed by in-plant printers.

Although in-plant printers are third on this list, there has been a renewed interest in VDP software. More than 16% of all in-plants indicated they were considering the purchase of VDP software, which was the highest of these three groups.

This is consistent with our consulting experience. In the last 16 months, we’ve had conversations with in-plants considering the purchase of variable data printing software. These conversations focus on how VDP software can help:

- Offset declines in the volume of static pages,

- Increase pricing and profitability for VDP pages, and

- Help demonstrate greater strategic alignment to their parent organization.

Increasing strategic alignment is often considered one of the most difficult tasks for in-plant printers. Every day, senior level executives within large enterprises are approached by companies offering outsourcing and facilities management services. In these meetings these companies ask, “Why are you managing a printing service? It is not your core competency, you don’t have the volume or resources to be cost competitive, and it is not strategically aligned with the mission the company.”

While leading in-plants can benchmark performance, they often struggle to prove strategic alignment. However, variable data printing can’t help in-plants demonstrate greater strategic alignment. Transactional printers that maintain communication with clients and send bills and statements are typically better aligned with the parent mission of the organization than other in-plants. University in-plants that often print a large portion of stationary products can demonstrate better strategic alignment using variable data printing to improve fund raising and increase student enrollment through recruiting.

More important to commercial printers is the prediction of a 17.6% growth in variable data printing by 2018. Not only is variable data printing a growth opportunity, it’s also a more profitable product in static pages which are often considered commodity products.

Overall the growth of variable data printing pages is accelerating for color pages and declining for black and white pages. The retail value of personalized printed pages in the United States is expected to grow 4.5% between 2013 and 2018. Within this 4.5% gross, there is a decline of 4.2% for black and white pages and a growth of 6.4% for color pages. Last but not least we believe that success with VDP is a stepping stone to success in selling more marketing services.

—

Howie Fenton is Associate Director of Operational Consulting at InfoTrends. For 25 years, he has worked with in-plants and commercial printers on: benchmarking operational and financial performance, strategies to become industry leaders, and recommendations to increase productivity, reduce costs and increase sales. To email click here.

Comments are closed.